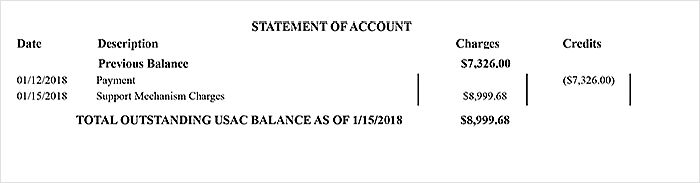

Statement of Account

The “Statement of Account” portion of a USAC invoice shows the previous balance due and summarizes all transactions that have occurred on a company’s account since the last invoice was processed. This includes support mechanism charges, FCC Forms 499 A/Q annual true up adjustments (debits and credits), late filing fees, payments made, interest and penalties, as well as other miscellaneous charges that are detailed in the body of the invoice.

The statement of account also shows the company’s total outstanding USAC balance which is the sum of the previous balance and current transactions.

The total outstanding USAC balance is as of the date indicated and may not be the total amount due as of the payment due date. If your USAC account has any delinquent debt that is or will be over 30 days delinquent when the payment is made, log into E-File and click the Payments tab. Navigate to the Total Payment Due section under the Summary label to obtain the payoff amount as of the current day.

Statement of Account Components

- Date – The date that the line item was applied to the account

- Description – Indicates what is being applied to the account

- Charges – Indicates the debits (amount owed by the company) applied to the account

- Credits – Indicates the credits (reduces balance due to USAC) applied to the account

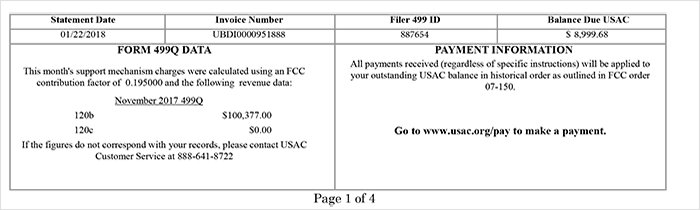

At the bottom of page one of the invoice, the left box identifies the FCC Form 499-Q data used to determine the support mechanism charges for the month. The right box identifies the online link to make payments to USAC.