Beneficiary and Contributor Audit Program (BCAP) and Supply Chain Audit Program (SCAP)

The Beneficiary and Contributor Audit Program (BCAP) and Supply Chain Audit Program (SCAP) are designed to assess universal service beneficiaries’ and contributors’ compliance with FCC rules. USAC works closely with the FCC to develop and implement these audit initiatives.

BCAP/SCAP audits may be performed by USAC’s internal audit staff, audit firms contracted by USAC, the FCC Office of Inspector General, FCC Enforcement Bureau, audit firms contracted by the FCC, or offices of other federal agencies (e.g., Government Accountability Office). Contact USAC’s audit team via email if you have any questions or concerns as to the proper identity of an individual contacting you regarding an audit.

If any non-compliance is discovered during an audit, the auditor will recommend a recovery of funds commensurate with the FCC rule violation. If any potential waste, fraud, or abuse is discovered during an audit, the auditor will also refer the matter to the FCC Office of Inspector General and the FCC Enforcement Bureau for additional action.

What You Can Expect During an Audit

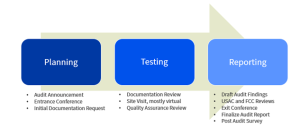

The audit process consists of three main phases (planning, testing, and reporting). See image below for examples of audit activities in each phase.

Understanding the Audit Process

Planning

If an entity has been selected for an audit, an announcement letter will be sent to the entity’s designated point of contact (as identified on its FCC Form 498) detailing the purpose and scope of the audit, identifying the personnel who will be performing the audit, describing the initial documentation request, stating the date upon which the documentation is due, and providing instructions on how to submit the documents.

Note: The entity may be contacted by USAC or the outsourced audit firm prior to the issuance of the announcement letter to make an appropriate introduction. The audit team will schedule an entrance conference meeting to discuss the audit process in detail, including the initial documentation request.

Testing

During the audit’s testing phase, the following areas will be tested.

- Contributors:

- Completeness of revenue

- Reseller revenues and other Block 3 reporting

- Classification of products

- Jurisdiction allocation

- Bundling methodology

- USF recovery charges and associated reporting

- Uncollectible revenue

- Contributors – Example of Documentation Requested

- High Cost program (Modernized and Legacy Funds):

- Eligibility requirements

- Line count submissions

- Data submissions

- Documentation to support a sample of assets, expenses, affiliate transactions, payroll, depreciation, etc.

- Deployment obligations, including speed and latency reporting and eligible structures (modernized funds only)

- High Cost – Example of Documentation Requested

- Lifeline program:

- Subscribers and amounts claimed on the Lifeline Claim System (LCS)

- Beneficiary eligibility to receive Lifeline program support;

- Subscriber eligibility to receive Lifeline program support;

- Beneficiary’s billing records to validate Lifeline support passed through to subscribers;

- Beneficiary’s subscriber bills to validate Lifeline support passed through to subscribers on a sample basis;

- Documentation showing if the beneficiary is a reseller of telecommunications services that support Lifeline subscribers;

- Beneficiary’s financial records and other documentation to show that no commission was paid to enrollment representatives; and

- Beneficiary’s tariff and advertising materials for service plans and equipment to demonstrate compliance with the minimum standard service.

- Lifeline – Example of Documentation Requested

- E-Rate program:

- Applicant eligibility

- Competitive bidding process

- National School Lunch Program (NSLP) discount calculations

- Disbursements

- Children’s Internet Protection Act (CIPA) compliance

- Delivery and/or installation of eligible products and services

- E-Rate – Example of Documentation Requested

- Rural Health Care (RHC) program:

- Health care provider (HCP) eligibility

- Competitive bidding process

- Payment of non-discounted portion/reimbursement

- Amounts invoiced to the program

- Delivery or installation of eligible products and services

- Documentation to support urban and rural rate calculations

- Rural Health Care – Example of Documentation Requested

- Supply Chain:

- General documentation in support of general audit requirements

- Network documentation to demonstrate compliance with the FCC’s supply chain rules related to network expenditures

- High Cost documentation to support the certification of the FCC Form 481

- E-Rate documentation to support the certification of the FCC Form 473

As potential audit findings are discovered during the audit, the entity will be notified as soon as possible to be given an opportunity to provide adequate and sufficient documentation to prevent an audit finding.

Reporting

After testing is completed, an exit conference will be held with the audited entity to review the audit results.

If there are any FCC rule violations found during the audit, they will be noted as an audit finding. An audit finding is a condition that shows evidence of noncompliance with FCC rules and orders set forth in Title 47 Code of Federal Regulations (CFR) Part 54, as well as other program requirements (collectively, the Rules). An “other matter” is a condition that does not necessarily constitute an FCC rule violation but warrants the attention of the auditee and USAC management. The audit findings and “other matters” will contain background information, the audit procedure performed, the condition noted, the monetary effect, and the auditor’s recommendation.

The audited entity will be given an opportunity to respond to the audit findings and “other matters” (if any) within five business days – unless advised otherwise by the auditor. USAC management will review the audit finding, including the audited entity’s response, and will include its response to address the audit finding.

Both the audited entity and USAC management responses will be incorporated into the draft audit report and submitted to the FCC for review. Once the audit is finalized, the audited entity will receive a copy of the final audit report. The final audit report may be included on USAC’s website and may be made available to the public upon written request.

A list of the most common audit findings for each USF program can be found at the following links: High Cost, Lifeline, E-Rate, RHC, and Contributors.

Post-Audit Activity

The monetary effect associated with the FCC rule violation will be calculated, and the auditors will recommend USAC management seek a recovery of funds. If USAC management agrees with the auditor’s recommendation to recover funds, they will send a notification or recovery letter to the audited entity. If the audited entity disagrees with USAC management’s decision to recover funds and is aggrieved by such action, the audited entity may file an appeal to USAC pursuant to 47 § 54.719.

Helpful Tips

The following best practices will help minimize audit findings:

- Research. Stay abreast of FCC rules and program requirements.

- Perform quality assurance checks. Review filings/data submissions for accuracy prior to submitting them to the auditors. Check specific data, not just summaries.

- Document, document, document. Retain and provide appropriate and adequate documentation to support filings, eligibility requirements, data, etc. FCC rules require program participants to keep documentation for a specific number of years (e.g., five or ten years from disbursement).

- Provide sufficient detail on all bills, invoices, and communications with vendors/applicants.

- Provide reconciliations for any conflicting or unclear information in reporting.

- Get organized. Keep documentation in an organized manner and easily accessible for times of transition or turnover.

If you have any questions, contact USAC’s audit team via email.

See common audit findings for each USAC program.

Connect with USAC’s Audit Team if you have questions.