Document Retention

All E-Rate program participants—applicants, service providers, and consortia—are required to maintain documentation that demonstrates compliance with the statutory or regulatory requirements for all E-Rate program purchases of equipment and services. The use of a consultant or other representative does not negate the responsibility of the school, library, consortia, or service provider to be in compliance with the Commission’s document retention rules. E-Rate participants must keep these records for a period of 10 years after the latter of the last day of the applicable funding year or the service delivery deadline for the funding request, whichever date is later.

The FCC first established document retention requirements for school and library applicants and service providers in the Fifth Report and Order (FCC 04-190) and provided an illustrative list of examples of the types of documents that should be retained. The FCC extended the document retention period to 10 years in the E-Rate Modernization Order (FCC 14-99) and clarified that the record retention and audit requirements apply to all program participants including any consortium that includes eligible schools and libraries. Examples of documentation that must be retained include:

-

- Pre-bidding Process. Applicants must retain all pre-bidding documents. For example, if consultants are involved, applicants must retain signed copies of all written agreements with such consultants. Proof of E-Rate eligibility must be retained for some entity types (e.g., non-instructional facilities, school residential facilities, Head Start, pre-kindergarten, adult education, and juvenile justice programs). Tribal libraries, including Tribal College and University (TCU) libraries, must retain evidence of eligibility such as a Tribal charter or ordinance, letter from the Tribal Council from authorized official, or other documentation from an authorizing entity that shows that the entity has characteristics of a library, including regular hours, staff, and materials.

- Bidding Process. All documents used during the competitive bidding process such as Request(s) for Proposals (RFP) or equivalent, including any amendments and addendums to the RFP; documents describing the bid evaluation criteria, weighting, and evaluation worksheets; all written correspondence between the beneficiary and prospective bidders, and all bids submitted (both winning and losing); and documents related to the selection of service provider(s) must be retained. Service providers participating in the bidding process that do not win the bid need not retain any documents.

- Contracts. Both applicants and service providers must retain executed contracts, signed and dated by both parties. All amendments and addendums to the contracts must be retained.

- Application Process. Applicants must retain all documents used to submit the FCC Form 471, including National School Lunch Program eligibility; and documents to support the necessary resources certification including budgets.

- Purchase and Delivery of Services. Applicants and service providers must retain all documents related to the purchase and delivery of E-Rate eligible services and equipment.

- Applicants and service providers must retain documentation sufficient to show delivery of the approved eligible equipment and services. The delivered equipment and services should match the equipment and services that were invoiced to the applicant and reimbursed through the E-Rate program.

- Invoicing. Both applicants and service providers must retain all invoices including records proving payment of the invoice, such as accounts payable records, service provider statements, beneficiary checks, bank statement or ACH transaction record, as applicable.

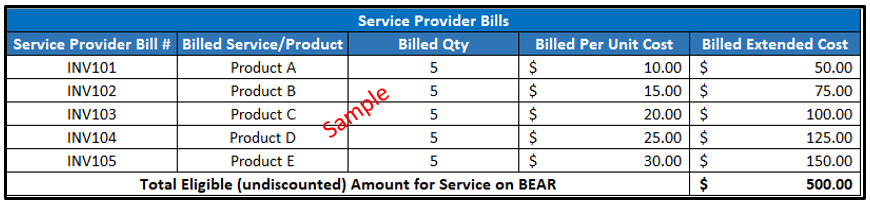

- Applicants and service providers should also maintain a reconciliation worksheet that includes Service provider bill number, billed product or service, quantity and cost per unit, extended billed amount, and sum of all the extended bill amounts that agrees to the total undiscounted amount, so that amount for equipment or service requested on the BEAR form can be traced to the actual copies of the service provider bills

- Asset and Service Inventories. Schools, libraries, and consortia must maintain asset and service inventory records of equipment purchased as components of supported Category Two services (internal connections, managed internal broadband services, and basic maintenance of internal connections) for a period of 10 years after purchase. Applicants must also retain detailed records documenting any transfer of equipment.The asset and service inventories should be kept as follows:

- Schools, school districts, and consortia, including any of these entities

- For equipment purchased as components of supported Category Two services, the asset inventory must be sufficient to verify the actual location of such equipment

- Libraries, library systems, and consortia, including any of these entities

- For equipment purchased as components of supported Category Two services, the asset inventory must be sufficient to verify the actual location of such equipment.

- Schools, school districts, and consortia, including any of these entities

- Acceptable Use Policies.

- Children’s Internet Protection Act (CIPA). Applicants must maintain documentation to demonstrate CIPA compliance, including documentation supporting that reasonable public notice was given for the public hearing, filtering documentation (purchase, installation, use), a copy of its Internet safety policy or acceptable use policy (AUP), documentation of the adoption of such policies, or that it is undertaking actions to comply with CIPA (e.g., reasonable public notice, public meeting or hearing minutes).

Forms and Rule Compliance. All program forms, attachments, and documents submitted to USAC and all other documentation that demonstrates compliance with the Commission’s rules must be retained by applicants and service providers.

Note that FCC rules have changed over the years so the descriptive list above is provided as a guideline but cannot be considered exhaustive. Use the E-Rate Program List of Documents to Retain for Audits and to Show Compliance with Program Rules as a guide to understand the types of documents that should be retained.